I enjoy writing a column for the NACD So Cal chapter on one of my favorite topics: Directorship 2020 with Fay Feeney.

This edition I interviewed Chad Spitler, Global Chief Operating Officer for BlackRock’s Corporate Governance & Responsible Investment team.

_________________________________________________________________________________________

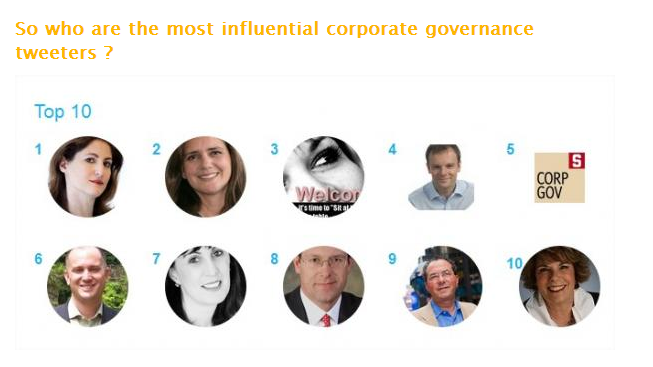

See Who are the Top Tweeters in #CorpGov

_________________________________________________________________________________________

News from the SEC created another disclosure channel for the boardroom to govern. “Adapting new technologies such as social media to provide increased information in real time to investors from Wall Street to Main Street is in the best interests of all capital market stakeholders,” Fornelli said.

And with that social media can now be an agenda item. Hope you take a minute to read this informative overview which includes a link to the SEC social media guidance.

New SEC Guidance OKs C-suite Tweets

Posted By Cheryl Soltis Martel On April 4, 2013 @ 2:29 pm

The Securities and Exchange Commission’s (SEC) approval of social media as a form of disclosure may be good news for companies looking to communicate with shareholders quickly and frequently, but for directors it’s another disclosure channel to scrutinize. The new guidance, released Tuesday by the SEC, allows companies to disclose pertinent information on social media channels, provided investors have been told which channel will be used to share information.

To read the SEC’s social media guidance, click here [1].

Netflix Reed Hastings at the Apple Worldwide Developers Conference in 2010. (AP Photo/Paul Sakuma)

Netflix Reed Hastings at the Apple Worldwide Developers Conference in 2010. (AP Photo/Paul Sakuma)The release of these guidelines stems from a 43-word Facebook post [2] Netflix CEO Reed Hastings typed in July 2012, noting that subscribers had watched 1 billion hours of video in June. The day after Hastings’ post, Netflix stock rose 6 percent, leading the SEC to investigate whether the the company may be violating the Regulation Fair Disclosure rule. Reg FD requires all investors to receive information that could affect company stock at the same time. The SEC ultimately did not initiate an enforcement action against Hastings or Netflix, but the commission did note that personal social media accounts of executives would generally not be considered the appropriate channel for disclosure, unless investors are expressly told this channel may be used in that manner.

In the guidelines, the SEC suggests companies could note on websites and press releases that they will use social media to make key announcements and also provide web addresses for their social media pages so investors can prepare.

“The SEC ruling just confirms what we already know—social media is here, and here to stay. It’s just another channel of information, like the World Wide Web before it and faxes and mailed press releases before then,” said Anne Sheehan, director of corporate governance at CalSTRS, when asked for her reaction to the new guidelines. “As long as it’s open and democratic, available for all to see, we’re all for it. Hash-tag, CalSTRS!—and friend us, too.”

“Adapting new technologies such as social media to provide increased information in real time to investors from Wall Street to Main Street is in the best interests of all capital market stakeholders,” Fornelli said.

While the SEC’s embrace of social media for disclosure may be good news for investors, directors may need to step up their pace of adaptation to such digital channels. According to a 2012 study [3] by The Conference Board and the Rock Center for Corporate Governance at Stanford University that surveyed more than 180 senior executives and directors of North American public and private companies, more than 90 percent of survey respondents say their companies do not have a board committee that is responsible for social media oversight.

Before a board can consider delegating social media responsibilities to a committee, it must first find a place on the agenda, notes Fay Feeney [4], CEO of Risk for Good, an advisory firm focused on helping the C-suite close information gaps on emerging issues for their board. “The board has some listening to do on where and how social media is being used by customers, investors, and employees,” she explains. “This is a full board exercise to understand how and who is speaking for and about the company. Once the board understands the context for social technology for their company they can take on governing.”

Although directors have been hearing about the risks of not utilizing social media to monitor what is being said about their organizations and industries, they have yet to fully embrace these platforms and often are skeptical of the information provided, The Conference Board and Rock Center report noted. Forty-four percent of the survey respondents say the quality of information they receive on social media risks is mediocre or poor with 1 percent claiming it is excellent.

From an oversight perspective, this lack of knowledge about what their stakeholders (employees, customers, suppliers and investors) are saying and doing in today’s social world is creating undue risk, Libert notes. “Many organizations, and their boards, are just beginning to realize the power of their connected customers to influence their financial and operating results as they use these new technologies to ‘showroom’ (real time comparative pricing with peers) as a simple example,” he says. “As a consequence of this emerging reality, the SEC’s recent announcement now enables boards to take a more proactive role in a hyper-connected, social world.”

_______________________________________________________________________________________________________

_______________________________________________________________________________________________________

Monitoring Risks Before They Go Viral:

Is it Time for the Board to Embrace Social Media?

Stanford Graduate School of Business

Given the pervasiveness of social media and the potential impact it can have on corporate activities, some experts recommend that boards of directors pay closer attention to the information exchanged on these sites.

For example, consultant Fay Feeney argues that “boards need to adapt to a connected world where listening, disclosure, transparency and engaging is expected.”

Read the full PDF article by clicking the Download button below.