“You need to have short term performance to get to the long term.”

Bill is the leader that makes following easy. He likes to keep it simple and focus on the alignment of three primary stakeholders: customers, investors and employees. He brings his interest in people into view with this wisdom “let’s build a company that provide meaningful benefits not at the expense of each other.”

His eye for talent focuses on people who understand priority and bring persistence till they get it right. As a leader he wants to ensure people who demonstrate these skills are given new opportunities.

It is great to see a self-aware leader who can say “As a CEO I don’t want to overstay my welcome and accept I only have a certain range of capabilities.” Boards, are you ready to hear this from your CEO?

Business Wisdom

The plan is a lot easier than the execution. Business is about people and change. You need the right critical mass of people. Opinion leaders are not on the formal organization chart. Find them and bring them in on the vision.

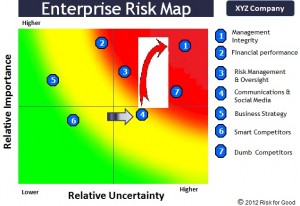

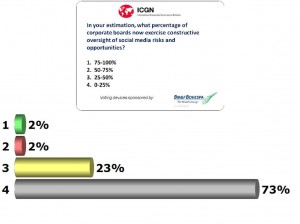

The board’s role is critical and is the most senior level of leadership. The role they serve for the CEO is holding the team accountable to the plan and being supportive of transformation. Things get worse before they get better so the board needs to understand the cycle of the strategy.

The right board leader has an agenda that brings out the strengths of the board. It is structured to:

- Focus on a few key things

- Bring balance on compliance and strategy

The board leader is the architect of the agenda. It is their duty to make sure the board does not spend too much time powerpointing which take time away from engagement. The way a board chair sets up the agenda builds a board intelligence culture. The chair should ask themselves “How can the board be most helpful to the CEO.” [Read more…]