I’m back from my travels to Rio. The ICGN Annual Conference was an amazing gathering of investors from around the world. Their voices added to the corporate governance conversations I’m privileged to hear in the US . Our session on social media was a hit with attendees wanting to see how social media works from the investor perspective.

I’m back from my travels to Rio. The ICGN Annual Conference was an amazing gathering of investors from around the world. Their voices added to the corporate governance conversations I’m privileged to hear in the US . Our session on social media was a hit with attendees wanting to see how social media works from the investor perspective.

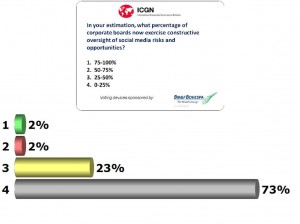

During the report out, Stephen Davis asked that audience the question:

“In your estimation, what percentage of corporate boards now exercise constructive oversight of social media risks and opportunities?”

One half of me is shaking my head while the other half is working on products and services to fast track boards, CEOs and investors into 21st century communications.

Here are the notes from our session and would welcome you adding to the ideas.

Social Media

Panel

Provocateurs: Santiago J.D. Chaher, Managing Director, Cefeidas Group, Argentina and Fay Feeney, CEO, Risk For Good, USA

Moderator: Stephen Davis, Executive Director, Millstein Center for Corporate Governance and Performance Yale School of Management, USA

Investors and corporate boardrooms alike increasingly see social media as a channel for advancing goals as well as a risk to manage. One illustration of the power of social media: during the ICGN’s first Rio day some 14 tweeters messaged on the conference from Brazil, the US, Canada, Portugal, Switzerland, Japan and Jordan. Totaling their followers, the number of people around the world who received at least one tweet from the conference was 93,781.

Provocateurs Fay Feeney and Santiago Chaher made the following main points:

• Companies facing viral crisis set up a “war room”

• Ongoing defenses include:

• Monitoring how firm and competitors are positioned in social media

• Maintaining an up-to-date inventory of relevant social media channels

• Embedding social media in corporate strategy

• Understanding ‘Big Data’ metrics and tools

• Establishing protocols for using social media within legal boundaries

• Boards should have someone with ‘digital literacy’, and other directors should have mentoring to bring them up to speed

• In the long term Big Data offer windows on real-time embryonic thinking rather than today’s historical data–deeper insights on consumer behavior and how it changes

Delegates were asked to discuss two questions:

1. What would you recommend boards do to prepare for social media risks and opportunities next season?

2. What can you imagine social media and technology allowing companies to do in 2020?

Points raised by delegates included the following: [Read more…]